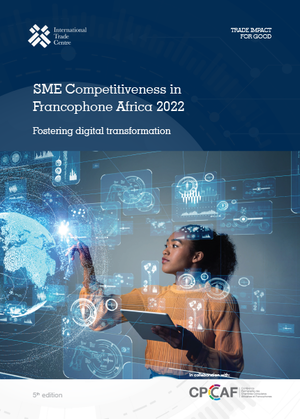

Invest in Africa’s tech sector: New report

African tech firms are poised for growth in the highly competitive digital technology market. See these country profiles in information technology and business process management in 11 African countries.

Information and communication technology (ICT) exports accounted for 4%–10% of sub-Saharan African service exports in 2021, making technology companies key to digital transformation of the continent.

While these firms capitalize on rising demand for digital services, they grapple with undeveloped ICT infrastructure and a narrow base of suppliers, according to African Market Trends in Technology Services: 11 Country Profiles, a new International Trade Centre (ITC) publication in its second edition.

Country tech profiles cover: Côte d’Ivoire, Democratic Republic of the Congo, Ethiopia, Ghana, Kenya, Nigeria, Senegal, South Africa, Uganda, the United Republic of Tanzania and Zambia.

Retail, financial services, healthcare, real estate and agriculture offer the best opportunities for information technology and business process management companies.

‘The decentralization and outsourcing of IT services are set to accelerate,’ said ITC Executive Director Pamela Coke-Hamilton. ‘This could be a big break for many African economies. COVID-19 brought greater trust in and ‘normalization’ of remote work, which benefits near- and offshoring of IT services even more.’

Most African countries have made rapid advancements in mobile phone and mobile internet penetration. Africa was the fastest-growing mobile economy in 2021, with more than 100 mobile subscriptions per 100 inhabitants in several countries. A quarter of all Africans were connected to the internet that year – and that share will rise to almost 44% by 2025, when 5G connections are estimated to reach 40 million.

Governments in Africa prioritize digital growth

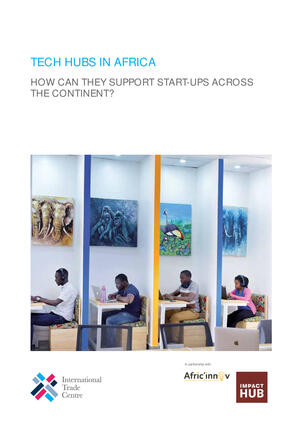

Rapid mobile growth demonstrates the efforts of African governments to build ICT infrastructure and the preference of African consumers for mobile technology. Faced with pressure to create jobs for youth and reduce reliance on traditional agriculture, mining and commodity exports, governments are promoting the digital sector – for instance, investing heavily through innovative public–private partnerships (i.e. with Huawei in South Africa and China International Telecommunication Construction Corporation in Democratic Republic of the Congo).

Governments are also developing ICT infrastructure, skills and service capacity, and providing incentives and concessions for foreign direct investment. Countries from Côte d’Ivoire and Ethiopia to Nigeria and Uganda offer inducements such as tax breaks and exemptions to attract foreign investors to their digital markets. The African Continental Free Trade Area (AfCFTA) also encourages governments to invest in digital infrastructure and technology, driving innovation in sectors such as logistics and digital services.

The AfCFTA’s single markets for goods and services helps tech companies reach more customers throughout Africa, the report says. Incorporating the Protocol on Digital Trade into the AfCFTA provides streamlining and a framework for digital platforms to grow. Harmonizing policy on technology and data movement promotes digital infrastructure development and connectivity across the continent.

African policymakers are working to improve access to education, train and upskill graduates, and motivate their tech sectors and service providers to develop talent and capacity. Nevertheless, while large economies such as Kenya, Nigeria and South Africa have made great strides – piloting 5G connecting and developing next-generation mobile and digital networks, for instance – smaller African countries still have a long way to go on tech infrastructure, the report finds.

Each country profile examines ICT infrastructure, government incentives, the regulatory environment and other factors that support tech and business process outsourcing service providers.