Africa's trade potential: Export opportunities in growth markets

Future opportunities for Sub-Saharan African (SSA) trade growth exist both within the region and in new emerging markets. Diversification to markets within the region in particular offer the best prospects for moving up the value chain to reduce dependence on commodities, while emerging markets, particularly in Asia, also offer high growth potential to offset stagnation in traditional markets.

A 2012 ITC study, Africa’s Trade Potential: Export Opportunities in Growth Markets, considers how SSA can achieve sustainability in export revenues by increasing the share of value-added products in its exports. The analysis also identifies strategic options and policies that could help SSA countries maximize trade-related economic growth until 2025 by tapping into growth markets in Asia, Latin America and their own continent, and by investing in trade-related infrastructure and trade facilitation programmes.

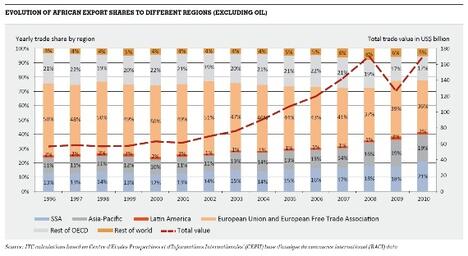

The reorientation of SSA exports away from stagnating developed markets towards Asia, and China in particular, has already begun. Asia is now the third largest destination for SSA’s non-oil exports after SSA itself and the European Union and countries of the European Free Trade Association. Further, trade between Western Africa and Asia is forecast by ITC to increase by 14% annually over the next decade, significantly outpacing overall growth in world trade. While these gains could be seen as positive developments, a large majority of SSA products destined for Asia are commodities, meaning a reorientation to growth markets is by itself not sufficient to achieve future sustainability. By simply turning towards Asia, the SSA region runs the risk of remaining vulnerable to commodity price shocks.

To assess the magnitude of potential trade and the economic benefits to SSA of various trade-related strategies and policies, the ITC study addresses the following questions:

- In which sectors and regions have SSA exporters performed well and moved up the value chain?

- What should policymakers do to maximize future trade potential, overall and while exporting to fast-growing markets in Asia?

Sectors and regions where SSA exporters have performed well SSA exports are already reorienting towards growing Asian markets but are increasingly composed of raw commodities. This means that efforts are needed to engage in higher value-added trade.

ITC analysis assesses SSA’s ability to move up the value chain, both on the import and export sides, in the following ways:

- By assuming that an increase in the share of intermediate goods in total SSA imports is a sign that transformative industries are being set up in the country, processing foreign inputs for domestic use or re-export;

- By assuming that an increase in the share of transformed goods in total SSA exports is a sign that transformative industries are being set up in the country, processing domestic or foreign inputs for export.

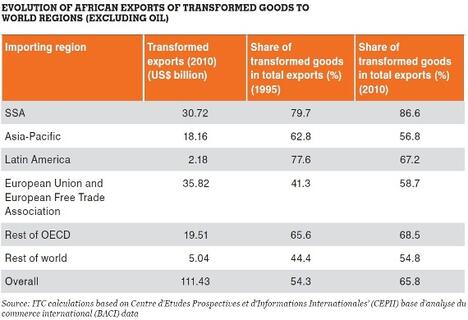

Overall, the share of intermediate inputs in total imports has remained stable while the share of transformed products, comprising semi- and fully processed goods, has increased. SSA's performance on the export side is displayed in the table above. The region’s exports of processed goods, such as bread, textiles and furniture, and semi-processed goods, such as flour, yarn and industrial alcohol, grew faster than exports of non-oil raw products between 1995 and 2010. In the case of intraregional exports, processed and semi-processed goods account for the largest share of non-oil exports, with 46% and 41% respectively. The ratio of SSA exports of fully processed goods to Asia, however, stands at a meagre 5%, leaving much room for improvement. Zooming into individual sectors, some success stories are notable as well. The leather sector is a good example of vertical integration in which a number of countries have established leather processing industries and increased their exports of finished leather articles. Less successful has been the cotton and textiles industry, where only three countries – Burkina Faso, Chad and Mali – increased the share of textiles in the sector’s total exports. Promising markets for these well-performing SSA countries and sectors are mostly found within SSA itself, as well as among traditional markets in Europe and other OECD countries. Exports to these markets have gradually shifted towards transformed goods, although they are not growing rapidly overall. Bearing this in mind, a policy mix needs to be identified that allows SSA to exploit its trade and growth opportunities by reorienting towards fast-growing markets and higher value-added exports simultaneously.

Improving transport infrastructure to benefit intraregional trade

SSA countries and Asia are forecast to grow rapidly in the coming decade, which will further fuel intraregional trade in SSA and trade between the two regions. Increased Asian demand is expected to particularly favour SSA primary products exports, such as oil, coal and gas. Against this baseline of forecast trade growth driven by economic growth alone, the ITC analysis simulates the potential effects of three types of policy changes:

- Reducing the time and cost of transporting goods in the SSA region by improving trade infrastructure, including ports and roads;

- Simplifying customs procedures in SSA;

- Simplifying customs procedures with Asia.

Improving SSA transport infrastructure and thereby cutting by half the cost and time required to transport goods within the region could boost SSA GDP by more than US$ 20 billion annually in 2025 and increase trade by up to 51% beyond the baseline level, according to an ITC simulation. This would mostly benefit intraregional trade, where the relative cost and time lost because of Africa’s poor transport network is the highest. Transformative industries would be most affected as they would benefit from better access to markets, inputs and machines. Among the three simulated scenarios examined in the ITC study, infrastructure improvements trigger the largest economic benefits, but because of the size of the African continent they are also likely to be the most costly.

Customs procedures are still a lengthy process, even though improvements have been made in some SSA countries in the past few years. A trade facilitation programme that would cut the time needed to comply with customs procedures at port by 50% could generate an extra US$ 15 billion annually in GDP for SSA. Finally, focusing on simplifying customs procedures with Asian trading partners would bring some benefit to SSA countries, but it would mostly benefit sectors with little value addition.

How policymakers should maximize future trade potential

Reducing transport time and cost through trade infrastructure projects should be a priority as it supports value-added intra-SSA trade. The ITC study provides a full picture of promising markets and sectors for SSA exports. A fast-paced reorientation of SSA exports towards fast-growing emerging markets is already under way, but it is concentrated on raw products in general and oil in particular. Without any firm policy action, predicted future growth patterns will favour this trend.

In parallel, some SSA countries are also engaged in higher value-added trade and some of the markets for transformed products are found within SSA itself. Therefore, infrastructure projects that support intra-SSA trade could be beneficial to the establishment of processing industries. Projects that aim to simplify customs procedures will bring slightly lower benefits, but will be far less costly to implement. Finally, bilateral initiatives that seek to enhance trade facilitation between SSA and Asia risk favouring trade in primary products. Such initiatives need to be accompanied by Asian investment into transformative industries in SSA to establish new supply chains between Asian manufacturers and their subsidiaries in SSA.