Value creation and purchasing strategy

Increasingly, as European manufacturers face fierce competition from new Asian sources, suppliers are looked to as sources of competitive advantage. This article discusses the strategic role that differentiated purchasing and supply management represents in support of companies’ overall product/market and business strategies.

Purchasing and competitive strategy

Industry in Western Europe seems under-represented in new technologies and industries. Many industries seem to face market saturation or decline. Many companies now focus on ‘selective growth’ – enhancing core activities and starting up new activities. One consequence is the shedding of non-core activities.

In general, the following reasons may underlie this trend:

• Increased subcontracting, as a result of ‘make-or-buy’ studies. For example, a manufacturer of office equipment found internal manufacturing costs substantially higher than those of external suppliers prompting a make-or-buy programme. As a result the company moved to a higher level of assembly and now focuses on design, assembly, marketing and sales, with most component manufacturing terminated.

• Buying of finished products instead of components. For example, the Western European textile industry has responded to competition from ‘low-wage countries’ by shifting production to developing countries. Large retailers buy the raw materials, which are then sent, together with the design, to low-wage countries.

• Turnkey delivery. Manufacturers of industrial fences, for example, need to deliver their products turnkey (at the buyer’s request), managing all installations, including safety and surveillance equipment (cameras, keyless entry systems) obtained from specialist suppliers resulting in an increase in the purchasing share of project costs.

• Technological development. The technology develops in some industries at such a pace that even large manufacturers cannot afford to keep up. Computer manufacturers obtaining their microprocessors from specialized suppliers is one example.

The agenda of purchasing and supply management has changed

The traditional agenda of purchasing and supply management has gradually changed. The traditional cost orientation in purchasing has involved doing more with fewer suppliers, global sourcing, aggressive sourcing and electronic tendering and contract management. Purchasing managers need to reduce downside risk through single sourcing, early supplier involvement, outsourcing and partnership agreements. Purchasing managers must challenge suppliers to provide superior value informed by a shared knowledge of future investment plans to drive supply chain integration. Relationships with suppliers become strategic.

Integrating purchasing into company policy

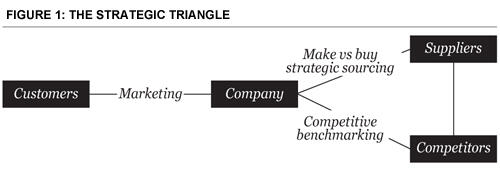

Overall business strategy requires positioning vis-à-vis three major stakeholders. Employees or ‘unions’ may represent a fourth as knowledge and human capital are recognized as key success factors. The ‘strategic triangle’ covers these stakeholders (see Figure 1):

1. Primary customer or target groups. Products and services need to be tailored to differentiated customer target groups requiring specific product/market strategies.

2. Major competitors. Companies must respond to customer needs to achieve a distinctive, sustainable competitive advantage over competitors e.g. superior cost position, brand image, product quality, logistics performance and customer service. Continuous benchmarking of overall performance is required against best-in-class in specific activities.

3.Major suppliers. Production activities and support services must be under continuing review to assess competitiveness. If the conclusion is that current production activities cannot be carried out competitively in the long run, it will be necessary to investigate subcontracting options and/or possible partnerships with suppliers.

One example is a European automobile manufacturer which transfers the design and production of compressor valves for automatic gearboxes to a specialized supplier. The relationship is one of mutual interdependence.

Global sourcing to achieve minimum total cost is replacing nationally oriented sourcing. Generic, basic products have a relatively predictable demand and long life cycle and lend themselves to global sourcing, whereas innovative specialty products with short, dynamic life cycles require a highly structured, local supplier network. This explains the adoption of both local and global approaches in dealings and relationships with suppliers.

Towards leveraged purchasing strategies

When adopting a value orientation, purchasing strategies must link to overall business strategies. While based at Michigan State University, Robert M. Monczka launched a Global Procurement and Supply Chain Benchmarking Initiative to enable companies to compare their purchasing and supply processes and to learn from best practices. Participating companies went through several cycles of the programme:

•Insourcing/outsourcing. Companies determine whether an activity contributes to achieving a competitive advantage. A decision is taken whether to insource or outsource.

•Develop commodity strategies in line with overall business strategy. The purchasing spend is examined in detail. ‘Commodity’ is defined broadly and may include raw materials, technical and high-tech components and standard, off-the-shelf products. Issues examined include whether to pursue product standardization and reduce product variety, the appropriate number of suppliers and desirable relationships. Commodity plans are mapped to identify responsibilities, timeframes and how progress will be monitored. Expected benefits must be clearly identified.

•Establish and leverage world-class supply base management. Supply base management covers how many suppliers for each commodity, conditions and qualifications the best-in-class suppliers should meet and how they will be selected. Suppliers are investigated and benchmarked.

• Develop and manage supplier relationships.Suppliers are grouped into distinctive categories such as those used by Philips: commercial suppliers (supply on agreed terms), preferred (reciprocal) and supplier parties (intensive work on new technologies, products and business opportunities). One measure of when a true partnership has been achieved is when suppliers no longer suspect that their customer is simply trying to find out, and cut back, their profit margins.

• Integration of suppliers in product development. Technical experts from the suppliers become part of the research and development teams and other project teams and vice versa. Reconciling differences in working methods, management style and culture can be challenging.

• Supplier integration into the order fulfillment process. Joint teams work on increasing

responsiveness and customer service, improving asset utilization, reducing pipeline inventories and improving transaction flexi-bility via information and communication technology.

• Supplier development and quality management. Suppliers are challenged to provide new ideas for improvement, e.g. product design, manufacturing technology and business processes. Suppliers may withdraw cooperation if they conclude their ideas are not given due weight.

• Strategic cost management. Both parties (or clusters of suppliers) work jointly with their customer to realize cost savings throughout the supply chain.

The author believes supplier development and quality management should be given a higher priority and be placed after the third part of the suggested programme.

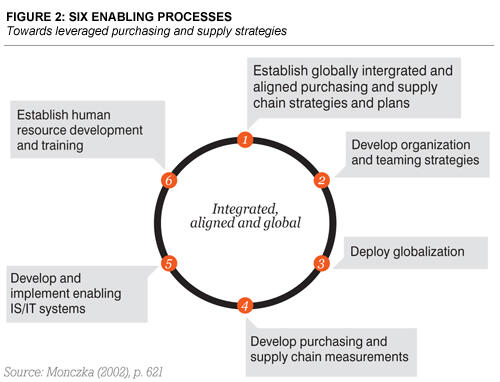

Purchasing managers need to give attention to six enabling processes (see Figure 2). Different products require different supplier strategies. Product groups and supplier base are analysed based on two criteria: purchasing’s impact on profitability; and the supply risk associated with the purchase of a specific item. The second step is to analyse the four product categories: strategic; leverage; bottleneck; and normal. Supplier strategies can be developed for each. Partnership and competitive bidding should be seen as complementary strategies rather than mutually exclusive. The four basic supplier strategies serve different objectives.

Summary

‘Concentrate on your core business’ has become today’s mantra as purchasing gains more attention from management. Many activities can be carried out at lower cost by specialized suppliers, companies gain flexibility and management can focus on ‘core business’. Purchasing’s strategic role is to develop a worldwide, competitive supply base and to integrate these suppliers effectively into the company’s business processes.

This is an edited version of an article that was first published in R. Boutellier and S. Wagner, Chancen Nutzen, Risiken Managen. Band 4, pp. 197--215. Zurich: SVME, 2005. A Spanish version was published in Gestion de Compras, Año X, No. 45, pp. 12--20, Enero--Febrero, 2006.

1Monczka, R.M. (2002) as quoted by NEVI (2002), Nederlandse bedrijven op weg naar Purchasing Excellence, Resultaten Project 1, Zoetermeer.