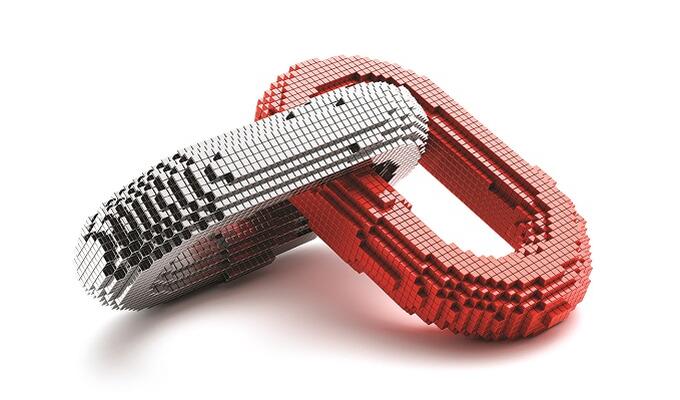

Why blockchain could become the new container of international trade

Digital record-keeping offers potential of lower costs, less cumbersome procedures

International trade in goods has experienced comparatively little innovation since Malcom McLean invented the intermodal sea container in the 1950s. Containerization revolutionized transport of goods. It cut freight costs drastically by removing the need for repeated handling of parcels. It did not, however, streamline bureaucratic processes or eliminate paperwork.

International trade transactions continue to rely heavily on paper forms. Shipping a container of roses and avocados from Mombasa, Kenya, to Rotterdam, the Netherlands, can produce a pile of paper 25 cm high and the cost of handling it can exceed the cost of moving the container. More than 100 people and 200 information exchanges are involved in the process, leading to complex and often duplicative administrative procedures, which weigh most heavily on small businesses seeking to participate in international trade.

A new technology, blockchain, is seen by many as the possible next game-changer.

Could it become the new container of international trade? What makes this technology so unique?

A blockchain is a digital record of transactions – the term is used here in its generic form to refer to distributed ledger technologies. It is decentralized (no single entity controls the network) and distributed (records are shared with all participants) and transactions are shared, verified and validated on a peer-to-peer basis. Transactions are time-stamped and stored in a highly secure, verifiable and nearly permanent way thanks to various cryptographic techniques. Smart contracts, i.e. computing programmes that automatically enforce themselves when specific conditions are met, can be used to automate transactions.

Blockchain therefore allows participants with no particular trust in each other to collaborate on an equal basis in real time with the guarantee that the information on the blockchain has not been tampered with. These unique characteristics make it a particularly interesting tool to accelerate the digitalization of trade and streamline trade processes.

The promise of greater efficiency and higher security is leading an increasing number of financial institutions to explore how the technology could better facilitate trade finance processes. With 80% of trade financed by some form of trade financing - letters of credit or supply chain financing - trade finance is the backbone of international trade. However, such processes, in particular letters of credit, remain labour- and paper-intensive.

That is changing. Various bank consortia including eTradeConnect, Komgo, the Marco Polo Network, Voltron and we.trade have emerged recently to offer trade finance services based on blockchain. The first results are encouraging and seem to confirm blockchain’s potential to significantly reduce the time needed to process transactions – in some cases from several days to just a matter of hours. The development of blockchain-based trade finance platforms could be particularly interesting for micro, small and medium-sized enterprises (MSMEs), which often struggle to access trade finance.

Likewise, key actors in the transportation and logistics sectors are rushing to establish platforms that would connect all actors along the supply chain, including freight forwarders, ocean carriers and port and customs authorities. IBM, a computer company, and Maersk, a logistics firm, opened the race with the launch of their Tradelens platform. Others are following suit. Gains could potentially be significant, with estimated shipping costs slashed as much as 20%.

The use of blockchain and smart contracts could also help enhance the efficiency of various border procedures, including certification and licensing; customs

clearance; revenue collection; identity management; and post-clearance audit. Various proofs of concepts have been developed to assess, for example, how blockchain could help facilitate procedures linked to e-phytosanitary certification, though exploration is still in its early stages.

One of the most frequently cited applications of blockchain in supply chains is traceability. Examples of blockchain projects to track products along the supply chain to prove their origin, attest authenticity, help detect counterfeits, track tainted products, and assert claims are legion. Provenance, Everledger and Blockverify are only a few of a myriad of startups offering such services. Several major retailers already use the technology on a day-to-day basis to track millions of products along their supply chain.

The opportunities that blockchain opens to facilitate and digitalize trade processes, enhance transparency and slash trade costs are potentially significant. While MSMEs in particular can gain through lower fixed costs and less burdensome procedures, these opportunities come with equally important challenges.

Like in the early days of the container, before an ISO standard was developed, there is not one single type of blockchain. Instead, there are a myriad of different technologies using different consensus mechanisms and ways to validate transactions. Many platforms do not talk to each other, which poses a particularly acute problem in the case of international trade as a single trade consignment can figure in multiple ledgers.

Developing a single blockchain standard is, however, unrealistic. Various distributed ledger technologies will continue to co-exist. Developing inter-operability solutions is

therefore critical. Scalability also remains a concern, in particular for public blockchains.

Last but not least, blockchain is only a tool. It will only succeed in facilitating and digitalizing international trade if e-transactions are recognized and other legal issues clarified.

Blockchain could have a truly transformative impact on international trade. It could become the new infrastructure underpinning international trade. Under-standing the practical and legal implications of blockchain on international trade and striving to develop collective solutions to current challenges is key if this technology is to have a chance to become the latest transformer of international trade.