Agriculture export value chain financing lifts indigenous producers in Fiji

Fiji Government backs expansion of ITC’s innovative approach to agriculture value chain financing to boost small island farmers’ incomes and exports

Fijian exporters and indigenous smallholder farmer suppliers face many challenges to meet rising demand. Under the UK-funded Trade Partnerships Programme (UKTP) the international Trade Centre (ITC) successfully applied an innovative market-driven approach to agriculture value chain financing to boost production and sustainable exports. This approach is now being expanded with new financing facilities.

In common with other developing countries, many indigenous farmers in Fiji lack land title documents or credit references and struggle to access financing to expand production. Supported by the UK High Commission in Fiji and advisers engaged from the Fiji-based Financial Management Counsellors Alliance (FMCA), ITC’s UKTP team designed a new approach to overcome financing obstacles.

What makes ITCs value chain financing scheme different?

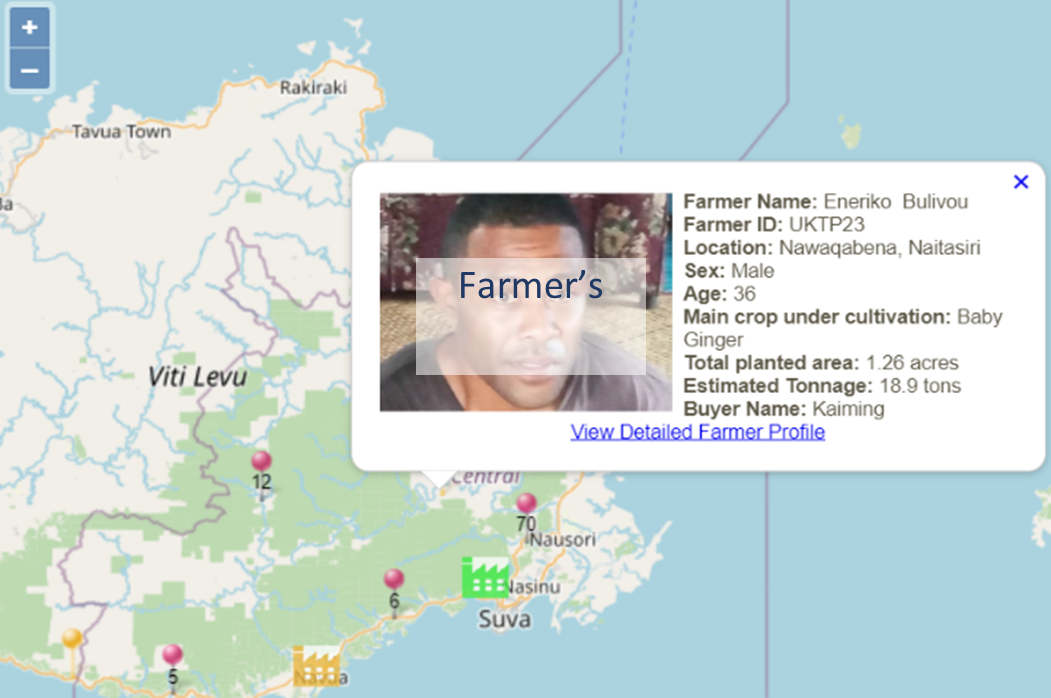

Mapping GPS coordinates of farm plots, profiling farmers, their products, water/mobile access, and sales has enabled financing providers to lend to women and young farmers. Aided by an Internet application financing providers, agriculture extension and bio-security services can see farmers’ and processers’ history and locations using an Internet platform. Visualisation opened-up financing by improving the accuracy of risk and performance assessments. It also provides opportunities to participate in Index insurance. ITC helped the Fiji Development Bank (FDB) to design a pilot agriculture value chain facility to extend small loans for expanding farm production based on the farm, processer and supply chain mapping.

In 2021, activities scaled-up with ITCs FMCA counsellors training and coaching more farmer groups to pre-qualify for borrowing and submit loan applications to FDB.

Philippe Helluy, ITC Senior Adviser for agriculture and value chain development said: “To ensure fair play, processer-exporters issue supply contracts to farmers with an agreed minimum price per kg for delivering crops compliant with their sales contracts. Based on these contracts, farmers and the project team developed cropping plans and budgets to submit with the small loan applications."

A crop lien put in place by the Bank with exporters provided additional collateral securing bank loan repayments from farmers directly against ginger sales receipts. As a result, almost 200 farmers received a series of affordable and predictable loans totalling more than US$700,000 to cover input costs, land preparation, machine hire, labour and transportation. There have been zero defaults over two years. The scheme has proven to be commercially viable despite the impact of cyclones, COVID and droughts.

Fiji Government backs expansion of the Agriculture value chain finance facility

On 26 May 2022, the Fiji Development Bank launched an expansion of the initial Agriculture value chain finance facility with a $1 million concessional funding line from the Reserve Bank of Fiji.

Saud Minam, Chief Executive Officer of FDB said at the launch: “The Agriculture value chain facility is specifically designed for new and existing ginger farmers with 4.99% interest rate per annum for individual loans up to $50,000. The new facility allows farmers in remote areas to lodge their loan applications online and receive funds via mobile wallets, such as M-PAiSA and MyCash. The UKTP/Fiji project facilitated this arrangement by conducting a successful prototype.”

Under this new arrangement between FDB and RBF, Fijian advisers, will provide technical assistance to indigenous farmers that includes market orientation, financial literacy and records management, good husbandry and postharvest practices. FDB and local advisers organise training, monitoring of loan disbursements and performance reporting for the scheme.

Results achieved in Fiji can be replicated elsewhere to improve food security

Now in its third year, the scheme has achieved:

- More than $700,000 worth of loans approved and disbursed with zero defaults.

- Value-added ginger exports have increased exponentially in volume and value. 163 farmers now enjoy farmgate prices of >$1.60 per kg for baby ginger – an increase of >60%.

- Indigenous farmers employ more young people from their villages. Fijian processer-exporters get predictable supplies and are expanding their workforce and processing facilities.

- An environmentally friendly intermediate processing facility is being built up-country and will employ over 60 people from Q4, 2022.

This market-driven scheme is very cost-effective. It supports good farmers and socially responsible, well-managed processer-exporters. ITC would like to hear from development financing institutions and donors to help expand the scheme to other food sectors and countries.

For more information or to implement agriculture value chain financing schemes in your country please contact:

Ian Sayers, Senior Adviser for access to financing and investment, sayers [at] intracen.org (sayers[at]intracen[dot]org) of send a message to financing [at] intracen.org (financing[at]intracen[dot]org) with “Agri Value Chain Financing Request” in the Subject line.