Historias

Drawing foreign venture capital into Uganda’s tech sector (en)

1 julio 2019

The challenge

It is said that talent is evenly distributed, but opportunity is not. However good their business ideas, would-be entrepreneurs in many developing countries face challenges that their counterparts elsewhere do not. Weak physical infrastructure may separate them from markets. Credit might be unobtainable; legal and regulatory obstacles might not favour new businesses.

In Africa, the digital economy has lowered some barriers to entry for entrepreneurs. Tech startups reach customers via the internet on their mobile phones. Platforms make it easier for suppliers and customers to connect, at home, elsewhere in Africa and abroad.

Yet even the most promising startups face serious challenges accessing finance. Banks typically demand high collateral and interest rates that most small enterprises simply cannot afford, leaving them reliant on loans from friends and family. Many watch their companies stagnate, or worse, go bust – not because of an inability to compete or an unappealing value proposition, but for want of capital to operate and expand.

The response

As part of the Netherlands Trust Fund IV (NTF IV) initiative, a multi-country, multi-project partnership with the Dutch Centre for the Promotion of Imports from developing countries (CBI), ITC has been working to bolster the international competitiveness of micro, small, and medium-sized enterprises (MSMEs) in Uganda’s nascent information technology sector.

ITC’s involvement in Uganda’s tech sector, which dates back to 2014, operates at three levels: capacity building and international business development support for startups; partnerships with local tech hubs to strengthen the business ecosystem; and coordination with government ministries and agencies to improve the policy environment.

Promising Ugandan companies in sectors from financial technology to e-commerce, education and agriculture receive training and advisory services customized for their maturity and specialization. This helps them develop business ideas and match products to market demand. Participation in regional and international trade fairs foster business-to-business (B2B) contacts with prospective customers. ITC has placed particular emphasis on creating opportunities for women-led companies and women in the tech sector more broadly. Crucially, ITC has sought to counteract the lack of local venture capital and other financing by fostering ties with international investors and partners.

The results

Leapfrog Ventures, a Tokyo-based venture capital firm that was one of the investors that ITC brought to Uganda, has injected funds into two Ugandan fintech startups, enabling them to escape capital constraints and invest in improving their products and entering new African markets.

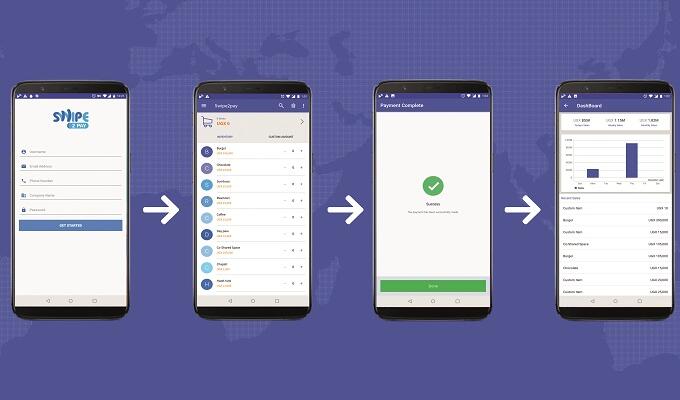

Xente, which received $100,000 in investment from Leapfrog Ventures, develops cash-free mobile payment systems for African businesses and their customers. Swipe2pay, which processes payments and operates cloud-based business and inventory management systems for brick-and-mortar retail and distributors, received $40,000 – the firm’s first external investment.

Both startups are associated with ITC’s work in Uganda. According to Swipe2pay chief executive Solomon Kitumba, these ties enhanced their credibility with Leapfrog Ventures when ITC brought the Japanese group’s founder, Takuma Terakubo, to the Ugandan capital of Kampala.

‘Being part of NTF IV built more confidence for the investor – that we were associated with a trusted organization and not going it alone,’ Kitumba explained. ‘This helped build trust and confidence for him. ITC then arranged for us to meet him formally. This is where we were meant to do our magic and yes, he was hooked.’ He noted that Leapfrog Ventures particularly liked Swipe2pay’s efforts to make it possible for small businesses to use business performance data – rather than having to post collateral – to obtain access to small loans.

ITC also facilitated Terakubo’s meeting with Xente and its chief executive officer, Allan Rwakatunga. Over two days of pitching, Rwakatunga and his cofounders met with the Japanese investor, who said he liked the business and the team, and wanted to invest.

Terakubo said that Xente and Swipe2pay were providing high-quality solutions to the challenges facing growth industries in Africa. ‘If ITC had not invited me to Kampala, I couldn’t have met them and wouldn’t have found an opportunity to invest in Uganda yet,’ he added.

Since launching a $4.5 million African fund out of Kigali, Rwanda in July, Leapfrog Ventures has invested in nine seed-stage startups in Eastern Africa and is targeting investments in 200 startups continent over a three-year period.

The future

Swipe2pay is using the investment to fund expanded computing and cloud service capacity that will enable it to scale up from serving hundreds of MSMEs to serving thousands. The company plans to launch into Rwanda and Kenya by mid-2019.

Xente also has ambitious plans to improve its products and boost customer numbers both in Uganda and four other African markets.

ITC is currently working to accelerate over 50 tech startups in Uganda and draw more investment into the local business ecosystem. A new pool of entrepreneurs is set to be onboarded in mid-2019. The methodologies developed by ITC’s tech sector development team are designed to be scalable in Uganda and elsewhere in sub-Saharan Africa.

It is said that talent is evenly distributed, but opportunity is not. However good their business ideas, would-be entrepreneurs in many developing countries face challenges that their counterparts elsewhere do not. Weak physical infrastructure may separate them from markets. Credit might be unobtainable; legal and regulatory obstacles might not favour new businesses.

In Africa, the digital economy has lowered some barriers to entry for entrepreneurs. Tech startups reach customers via the internet on their mobile phones. Platforms make it easier for suppliers and customers to connect, at home, elsewhere in Africa and abroad.

Yet even the most promising startups face serious challenges accessing finance. Banks typically demand high collateral and interest rates that most small enterprises simply cannot afford, leaving them reliant on loans from friends and family. Many watch their companies stagnate, or worse, go bust – not because of an inability to compete or an unappealing value proposition, but for want of capital to operate and expand.

The response

As part of the Netherlands Trust Fund IV (NTF IV) initiative, a multi-country, multi-project partnership with the Dutch Centre for the Promotion of Imports from developing countries (CBI), ITC has been working to bolster the international competitiveness of micro, small, and medium-sized enterprises (MSMEs) in Uganda’s nascent information technology sector.

ITC’s involvement in Uganda’s tech sector, which dates back to 2014, operates at three levels: capacity building and international business development support for startups; partnerships with local tech hubs to strengthen the business ecosystem; and coordination with government ministries and agencies to improve the policy environment.

Promising Ugandan companies in sectors from financial technology to e-commerce, education and agriculture receive training and advisory services customized for their maturity and specialization. This helps them develop business ideas and match products to market demand. Participation in regional and international trade fairs foster business-to-business (B2B) contacts with prospective customers. ITC has placed particular emphasis on creating opportunities for women-led companies and women in the tech sector more broadly. Crucially, ITC has sought to counteract the lack of local venture capital and other financing by fostering ties with international investors and partners.

The results

Leapfrog Ventures, a Tokyo-based venture capital firm that was one of the investors that ITC brought to Uganda, has injected funds into two Ugandan fintech startups, enabling them to escape capital constraints and invest in improving their products and entering new African markets.

Xente, which received $100,000 in investment from Leapfrog Ventures, develops cash-free mobile payment systems for African businesses and their customers. Swipe2pay, which processes payments and operates cloud-based business and inventory management systems for brick-and-mortar retail and distributors, received $40,000 – the firm’s first external investment.

Both startups are associated with ITC’s work in Uganda. According to Swipe2pay chief executive Solomon Kitumba, these ties enhanced their credibility with Leapfrog Ventures when ITC brought the Japanese group’s founder, Takuma Terakubo, to the Ugandan capital of Kampala.

‘Being part of NTF IV built more confidence for the investor – that we were associated with a trusted organization and not going it alone,’ Kitumba explained. ‘This helped build trust and confidence for him. ITC then arranged for us to meet him formally. This is where we were meant to do our magic and yes, he was hooked.’ He noted that Leapfrog Ventures particularly liked Swipe2pay’s efforts to make it possible for small businesses to use business performance data – rather than having to post collateral – to obtain access to small loans.

ITC also facilitated Terakubo’s meeting with Xente and its chief executive officer, Allan Rwakatunga. Over two days of pitching, Rwakatunga and his cofounders met with the Japanese investor, who said he liked the business and the team, and wanted to invest.

Terakubo said that Xente and Swipe2pay were providing high-quality solutions to the challenges facing growth industries in Africa. ‘If ITC had not invited me to Kampala, I couldn’t have met them and wouldn’t have found an opportunity to invest in Uganda yet,’ he added.

Since launching a $4.5 million African fund out of Kigali, Rwanda in July, Leapfrog Ventures has invested in nine seed-stage startups in Eastern Africa and is targeting investments in 200 startups continent over a three-year period.

The future

Swipe2pay is using the investment to fund expanded computing and cloud service capacity that will enable it to scale up from serving hundreds of MSMEs to serving thousands. The company plans to launch into Rwanda and Kenya by mid-2019.

Xente also has ambitious plans to improve its products and boost customer numbers both in Uganda and four other African markets.

ITC is currently working to accelerate over 50 tech startups in Uganda and draw more investment into the local business ecosystem. A new pool of entrepreneurs is set to be onboarded in mid-2019. The methodologies developed by ITC’s tech sector development team are designed to be scalable in Uganda and elsewhere in sub-Saharan Africa.